株式会社ソラストのウェブサイトをご利用いただき、誠にありがとうございます。

当社では、Microsoft社の発表を受けて、情報セキュリティの観点から、

Internet Explorerへのサポート対応を終了させていただいております。

ご利用いただくには、以下のブラウザに切り替えていただけますでしょうか。

誠に恐れ入りますが、何卒よろしくお願い申し上げます。

※ダウンロードとインストール方法などにつきましては、ブラウザ提供元へお問い合わせください。

Our corporate philosophy represents our mission and our reason for existing as a business. This philosophy also embodies the values we prioritize most at Solasto. We position our 2030 numerical goals and sustainability themes as representing our long-term goals to achieving this mission.

People. Technology.

Supporting comfortable living and energetic communities

The Solasto Group supports the happiness and well-being of our customers

by combining the advanced expertise and superior teamwork of our employees

with the innovative and flexible use of technology to provide medical, elderly care, child care,

and education services suited to the local communities we serve.

We are committed to putting energetic smiles on the faces of each of our employees

and establishing a society that provides peace of mind.

2030 Numerical Goals

Net sales

300billion yen

Operating profit

20billion yen

Establish ourselves asindustry leader

in medical outsourcing and elderly care

| Net sales | Op profit margin | |

|---|---|---|

| Medical outsourcing business | 100billion yen | 15% |

| Elderly care business | 150billion yen | 10% |

| New business and others |

50billion yen | 15% |

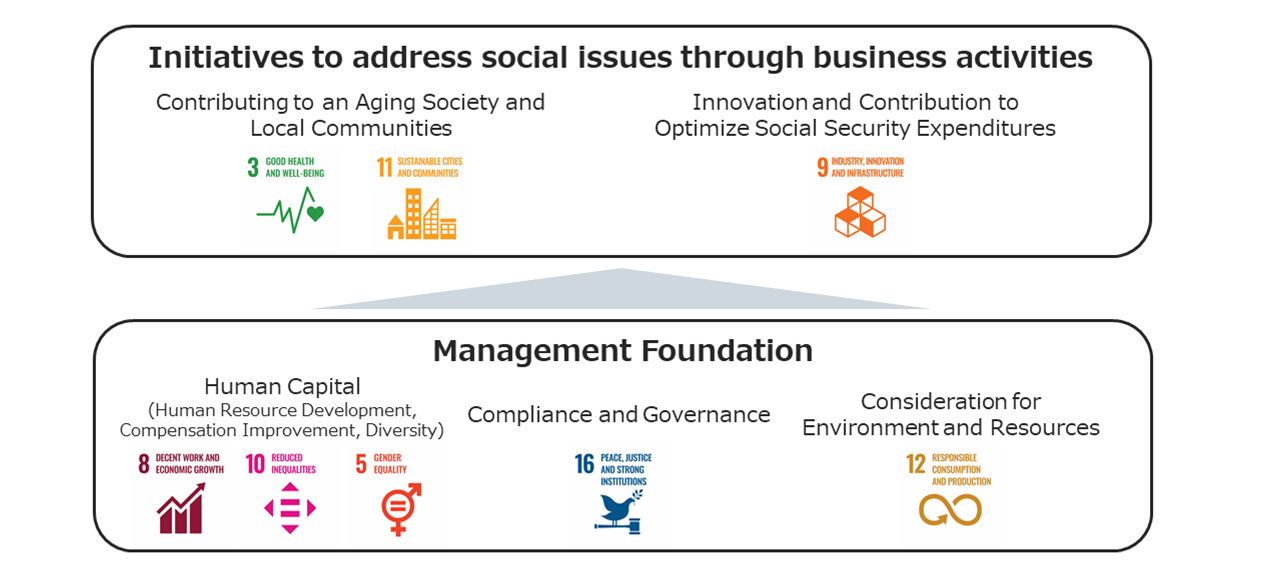

Sustainability Themes

Initiatives>「Solasto Sustainability Themes」

Sustainability Data>「Sustainability Data」

Our core competence is what distinguishes us from our competitors and is what serves as the driving force of our competitive advantage. Solasto is committed to continuously enhancing our core competence.

The ability to apply expert human resources and technology

towards service reform

and creative innovation in the workplace.

Company Information

Financial Information

Financial Reports

Stock Information